Share Holders Page

An information page for holders of shares in the VOC Spares Company

Change of management at Vincent Spares

made good progress including starting and developing the Workshop, implementing

new shop and financial systems, improving internal processes, bringing on new staff,

successfully getting through Covid and building revenue. We wish Bob the very best

for his retirement, with many good Vincent miles, and look forward to seeing him at

Desborough from time-to-time.

Ben Kingham joined us in 2023 in the Workshop, and was appointed Deputy

MD in January. Ben will take over as the Managing Director of Vincent Spares from 1st March.

Ben has lots of ideas on how he’ll build on the current achievements and take these forward.

way for bikes, spares and service; and building our successful business ever further.

THE VINCENT SPARES 2025 AGM IS BEING HELD AT 11.30 AM ON THE 10th MAY 2025 AT THE COMPANY OFFICES IN DESBOROUGH

I am pleased to announce the Annual General Meeting of your company will be held at 11.30 am on Saturday 10th May 2025, at the Club/Spares Co premises (Rear of 29 Station Road, Desborough NN14 2RL). Parking is very restricted so cars and non-Vincents should park outside the side lane entrance. Vincent motorcycles are welcome until site capacity is filled, and please respect our neighbours’ parking rights.

The agenda will be as follows:

- Apologies for absence

- Chairman’s address

- Directors Report and adoption of accounts

- To re-elect Ian Savage and Tim Kingham as Directors

- To re-appoint Duncan & Toplis as Accountants

- Any other business (to be notified to Company Secretary 7 days prior to the meeting)

The AGM is a formal meeting and any voting is of course confined to shareholders. However, after the formal meeting there will be an opportunity to raise any further matters with the Directors in a Q&A open session.

First, I would like to thank our excellent Staff, Managing Director and Non-Executive Directors for their commitment and energy to provide us with the best Spares Company among the classic bike clubs. We are also pleased to welcome Ben Kingham’s promotion to his new role as Deputy Managing Director – Ben is well known to many of you as an expert Vincent rebuilder (and indeed Goodwood race-winner).

Over the past few years I’ve explained the state of the company. Spare part sales to end-customers have for many years now been on a slow downward trend resulting in the past in some years of declining revenue for the company (especially once inflation is taken into account). Operating margin had declined to 2.1% (2022), insufficient to generate funds to invest in new products, services, replace equipment and build up stock.

Over the past couple of year, I’ve discussed the initiatives we have launched to address these major issues.

First, we started and have now substantially expanded our bike workshop services offering rebuilding, repair and servicing. We now have our team of three skilled Vincent engineers working on the bikes, reconfigured workshop, new equipment, refined workshop processes and ensured our insurance cover is fully suitable. Our expert workshop team comprises Ben Kingham, Robin Stafford and Ian Smith, all under MD Bob’s careful eye. The workshop revenue (parts and labour) have built up over 2.5 years so they now account for ~27% of sales.

Second, we’ve revamped our approach to bike sales, and this is starting to have effect and bike sales have really picked up over the past few months. We’re now typically selling ~2 bikes/month (in some previous years we were barely selling 2 bikes/year). Bike sales also of course drive additional spare parts and workshop revenue.

Third, we’ve invested in and improved our internal processes, shop and accounting systems, and Michelle Perkins is using these to support her ever-excellent customer service. One example of how these investments supports better customer service is that we now using the system capabilities to reduce stock-outs substantially. This is especially important as many supplier lead times have become longer.

And finally, we’ve sought to improve relationships between Club and Company. Our Liaison Officer ensures both Club and Company are well briefed on issues as they occur, and Stuart and I have instigated an annual Chairmen Club & Company meeting to discuss broader developments and ensure we’re linking up well in serving the Vincent Riders community.

A year ago I reported substantially improved financial results for 2023, and these higher levels have broadly been sustained for our 2024 financial year. Revenue is up 4.5% on last year, operating profit broadly similar, and net margin just under 6%. We have invested in increasing stock levels by 15% (selective investments both to reduce stock-outs and manage longer supplier lead-times), but still managed to maintain stable cash (essentially the investment has come from profits). Our balance sheet remains robust. The only disappointing factor is our tax bill has risen by 23% – perhaps we need to take some credit in contributing more funds to supporting broader society!

During the coming year, we want to continue ramping up our bike sales and workshop services, while maintaining our high level of service in providing our Vincent customers with spare parts. One initiative we are considering is investing in a bike tuning dynamometer/rolling road, which would enable us to set up owners’. bikes in the optimum way, as well as improving workshop efficiency. We know of no similar tuning service specialising on Vincents.

Our goal is to be the ‘Best for your Vincent’ – for parts, repairs and bikes. I look forward to seeing many of you at our AGM when you can meet the team, gain our special Open Day discount and discuss our progress further.

Malcolm McKenzie

Chairman, VOC Spares Company Ltd

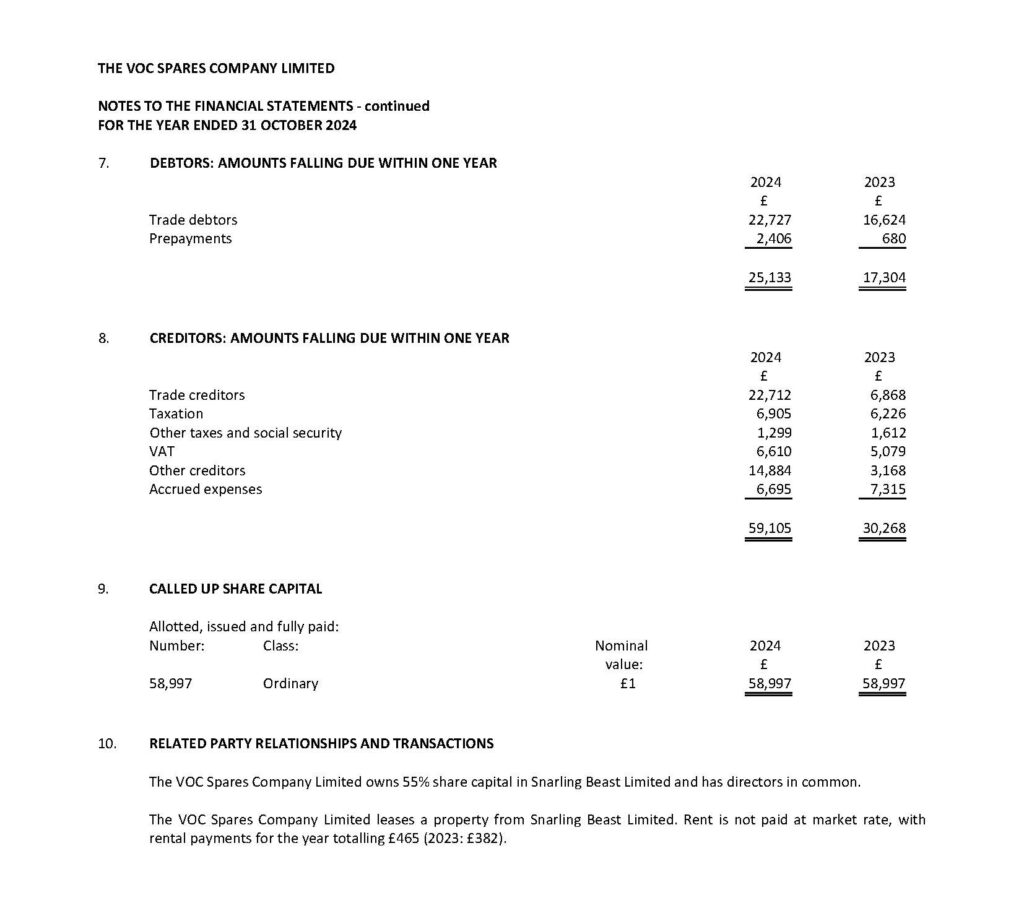

TRANSFER OF SHARES IN THE VOC SPARES COMPANY

Because of the way the Spares Company was launched back in 1975 and financed subsequently there were about 60000 shares issued and over 900 shareholders still are on record. The VOC Spares Company is a private unquoted company and it has never paid a dividend to its shareholders and it is very unlikely to do so in the future. The whole purpose of the company is to ensure spares continue to be available for the Vincent motorcycle and a subsidiary benefit is that individual shareholders (like VOC members) receive 10% discount on most spares they purchase.

SELLING

If you wish to sell your shares you have two ways to proceed. One is to privately locate a buyer. The other is to inform the company secretary who will place you on a list (however buyers contacting the secretary for shares is an infrequent occurrence). If a buyer is forthcoming then the secretary will place him in contact with you.

Once in contact with the buyer the shareholder or his Executor should negotiate a price, (The company has no part to play in this transaction)

When a transfer is agreed, you should inform the secretary who will send the shareholder an official form containing the details of the shares for the shareholder or his executor to fill in the new shareholders details and sign. The form should then be returned with the following:

The old Certificate or a statement regarding its loss

Any proof if necessary, of Executor status

A transfer fee of £25 (this may be sent separately by buyer) or by card to the spares counter

A new certificate made out to the buyer will be sent to the address on the form.

INHERITANCE or GIFT TRANSFER